- Published on

Equity Stock and Wealth Creation

- Authors

- Name

- Rajesh Padmanabhan

- @rajeshpadman

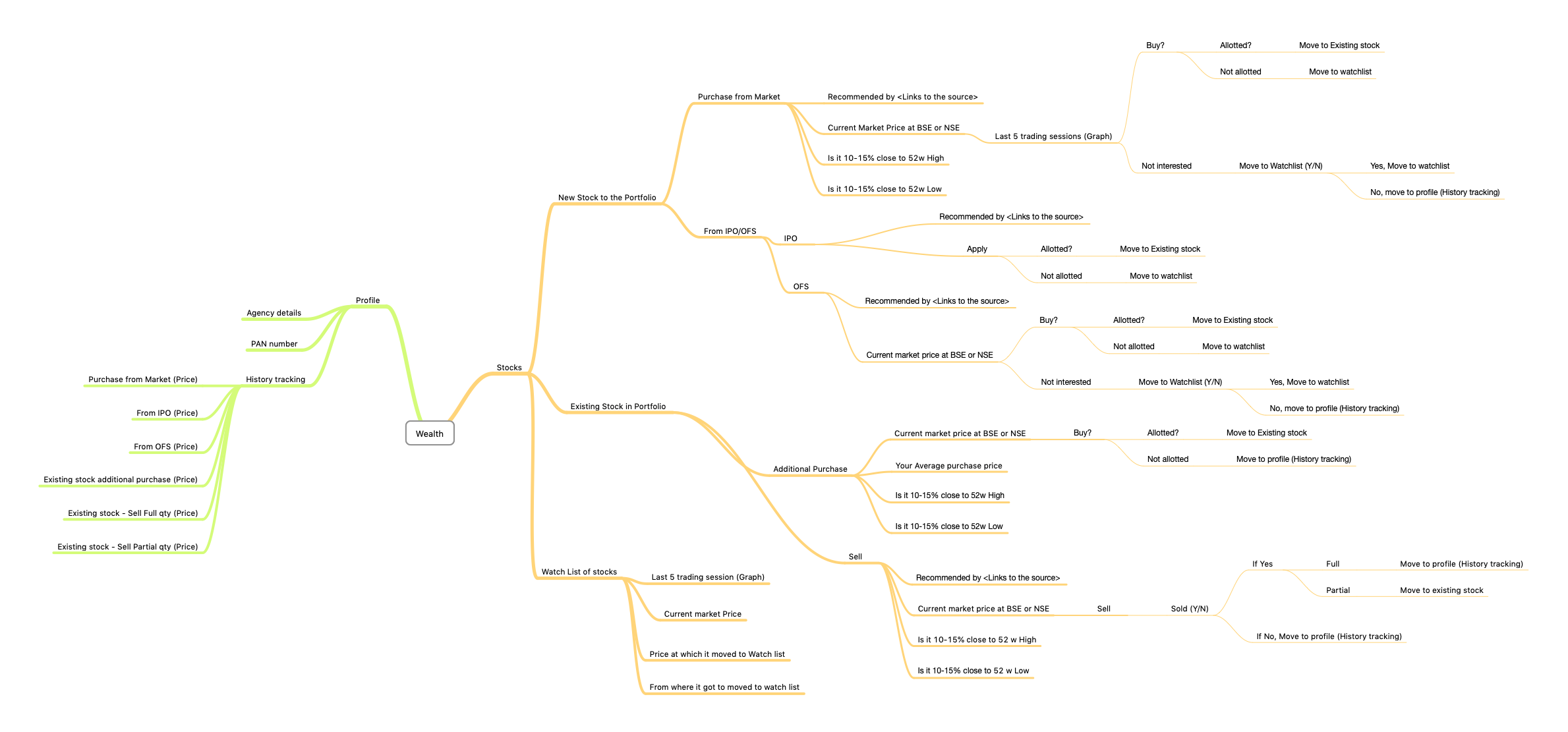

Equity stock and wealth creation - Mind Map

Continuing on the topic of wealth creation (and my thoughts were detailed here). One of the outcome of that chat session got to me think about my ‘future wealth’ - passive income. Have been a passive investor in stock market. My journey with market started with Equity Stock options that I received from my second employer.

Investment Options

There are multiple investment options available, some of the popular ones are

Have used multiple investment options

- Mutual funds

- Unit linked based

- Retirement focused

- Fixed deposits

- Equity stocks

- Cash at bank

I had invested in these. Slowly moved out of Mutual funds and Unit linked investments. For future have a minimum Retirement based investment. Has some fund on Fixed Deposits. Cash at Bank would be the minimum running expense for a Month.

It was not that I knew something about equity investments and latched onto it from the beginning. As many things happen in my life, equity investments also was not by choice. Being vulnerable has been a boon to me rather than a bane

Demat and Equity Stock Option Plan

As mentioned in the opening paragraph, was forced to open my Demat account during 2004. Opening of the account was mandated because my employer had allotted Equity Stock Options (ESOP) when they went public. I was eligible for the ESOP because of my long service to the company.

It’s a different matter that I was not even aware of ESOPs being given to me. That was a different world 🧞. So due to ESOPs got my Demat account created and thereby opening to the world of stock market.

World of Equity

During the initial days used to invest in equity stocks that are available through Initial Public offer (IPO). I also used to buy from the market, however this devoid any . But this purchase from market was devoid of any method to it. Just pure madness. Bought equity with instincts. The result has always been half-way.

Over the years realised that equity investment is interesting and challenging when done with proper data. You need data to support when you take calculated risks. It's always better than madness, especially when it is Money and Investment. As a stock investor before getting into a company equity you will be referring multiple options - Investment journals, newspapers, reference from friends, inputs from your investment banker amongst others. You need to record in one place the source of your input. This will help you in ‘trusting’ the source better and take a ‘calculated’ risks better. A trusted source helps you in identifying the correct equity to invest.

My Wish list

Never had a consolidated list of equities that I wanted or wished to buy. For example: the price at which I wished to buy; was it through Initial Public Offer; New fund offer; Rights issue or Direct purchase from market

My wish list of equity stocks weren’t available at a single place. Never had a consolidated list of my wish list and the price at which I wanted to buy or sell the stock. Was looking at various post-it notes, pieces of paper, physical notebooks, excel files, and notes applications

In trying to solve this, I did a mind map of my requirement and wish to have a ‘single source’ of information and take a better informed investment decisions.

Options Available in Market

At present there are multiple applications available for use. All of them have a key focus on investment for a purpose. This is important. However I wish to invest in equity stocks purely for the risk it possess and the dividends it gives. As they say 'Risk pays dividends'. I started investing in stocks by using my HDFC Securities Demat a/c. It has a mobile and web application to use. NSDL also gives a single source of my existing investments. None of these tools/services provide me an insight into the tracking. Doesn't have an option to keep my notes. Am not into day trading. Very rarely I exit a stock. When a person exits a stock and if he had booked profit, he would invest the money in another stock. Else he would have an urgent need for cash.

A track of why and when a person exits a stock is equally important for his future and further investments. This gives him an invaluable insights into the stock and thereby to the market in general. For example: I made good money when I sold and booked profit by selling the ESOPs. I also made a huge loss when I didn't exit a stock which I should have. There's a balance being made, but however I lost track of my investments. A tool would have been very helpful.

My Mind Map

Towards achieving this requirement I drafted a mind map that contains all my specific requirement towards equity and stock management. Am not sure when and how I will achieve and full fill this requirement.